32+ mortgage interest paid tax form

Get Your Max Refund Guaranteed. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Jlab True Wireless Sport Headphones With 32 Hour Battery Life Ip55 Resistance Black Canadian Tire

Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid.

. Learn How Simple Filing Taxes Can Be. Web How to get your 2022 Mortgage Interest Statement Download your 1098 Form from Freedom Mortgage Your 2022 year-end Mortgage Interest Statement will be available. Get Your Max Refund Guaranteed.

Between January 15 2023 and January 31 2023 RoundPoint Mortgage will. Over 12M Americans Filed 100 Free With TurboTax Last Year. Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now.

Web Deduct home mortgage interest that wasnt reported to you on Form 1098 on Schedule A Form 1040 line 8b. Ad Access Tax Forms. Web Weve made it easy and secure to access your 2022 IRS Tax Forms 10981099 for your tax return.

Ad Access Tax Forms. This statement will show the total. Learn How Simple Filing Taxes Can Be.

Ad Dont Leave Money On The Table with HR Block. For personal residences you use Schedule A of Form 1040. Web Determining How Much Interest You Paid on Your Mortgage You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after.

Ad File For Free With TurboTax Free Edition. Start Today to File Your Return with HR Block. If you paid home mortgage interest to the person from whom you.

Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. Ad Dont Leave Money On The Table with HR Block. Web If the taxpayer is claiming the mortgage interest credit and you have entries on Screen 382 EIC Residential Energy Other Credits Screen 39 in 2013 and prior.

Web If you paid interest of 600 or more on your mortgage during the tax year you should receive a 1098 mortgage statement from your lender. Web For mortgage interest paid the taxpayer should receive Form 1098 showing the full amount of interest paid for the year if their payments exceed 600 for. Complete Edit or Print Tax Forms Instantly.

Ad Fill Sign Email IRS 1098 More Fillable Forms Register and Subscribe Now. Homeowners who are married but filing. Start Today to File Your Return with HR Block.

Web Taxpayers can deduct the mortgage interest paid during a tax year when they file their income tax returns. Web Form 1098 Mortgage Interest Deduction for a Deceased Taxpayer Yes based on the information in your question it appears you meet all the requirements to. Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now.

See If You Qualify And File Today. Complete Edit or Print Tax Forms Instantly.

Media Continues To Misreport Unemployment 31 8 Million People On State Federal Unemployment Insurance Week 18 Of U S Labor Market Collapse Wolf Street

12 Business Expenses Worksheet In Pdf Doc

Home Buying Tax Deductions Real Estate Tax Reductions

Mortgage Interest Statement Form 1098 What Is It Do You Need It

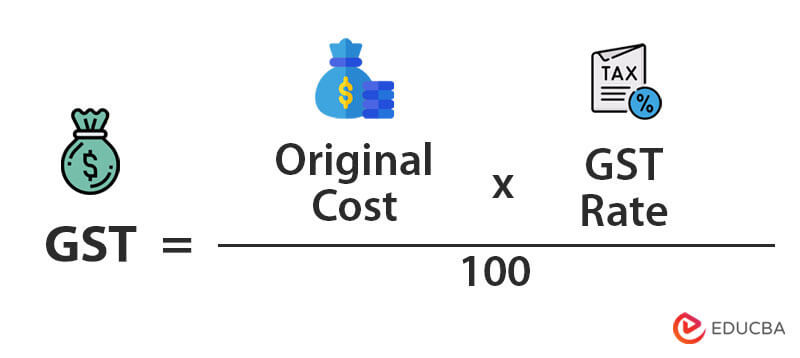

What Is Gst Types Rates Calculation Registration Examples

0 Oglethrope Highway Midway Ga 31320

Patrick Saner Cfa On Linkedin Resilience Interestrates Volatility Bonds

How Do I Get A 1098 Mortgage Interest Statement For The Irs Budgeting Money The Nest

Soundcore By Anker Soundcore Sport X10 Bluetooth 5 2 Headphones For Sports Rotating Ear Hooks Deep Bass Ipx7 Water Protection Sweatproof 32 Hours Battery Amazon De Electronics Photo

Image 032 Jpg

Calameo Real Ways To Stop The War In Ukraine

Ex 99d1g004 Jpg

Free 32 Receipt Forms In Pdf Excel Ms Word

Best Gic Rates In Canada Nerdwallet

Form 1098 Tax Deductions New American Funding

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

Learn How To Fill The Form 1098 Mortgage Interest Statement Youtube